Online payroll tax calculator

Updated with current IRS withholding information for 2018. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use.

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

These are located in the top right hand corner of your land tax assessment notice or correspondence from us.

. Input any additional pay like bonuses or commissions. Next generation payroll and HR in one powerful yet simple integrated solution for medium to large businesses. Guide RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary.

Perk Payroll also relieves Finance teams by generating challans - PF ECR text file for PF and ESI Form MC for ESI PT Form V for professional tax and Form 24Q for TDS calculation. Virginia Tax designed this page to provide documentation available services and updated tax resources used by tax preparers and payroll providers who assist customers with their tax needs. View what your tax saving or liability will be in the 20222023 tax year.

IRS Withholding Calculator - The IRS encourages everyone to use the IRS Withholding Calculator to perform a quickpaycheck Checkup This is even more important this year because of recent changes to the tax law for 2018. Tax Deducted at Source TDS Profession Tax Slabs. We designed a handy payroll tax calculator with you in mind.

With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. See Oklahoma tax rates. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy.

Fast ReliableGreat supportSignup TODAY. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you have not received an assessment notice or.

In some cases this calculation may be slightly off but the difference shouldnt be much. You must register for land tax if the value of all your taxable land is above the land tax threshold even if you havent received a notice of assessment. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

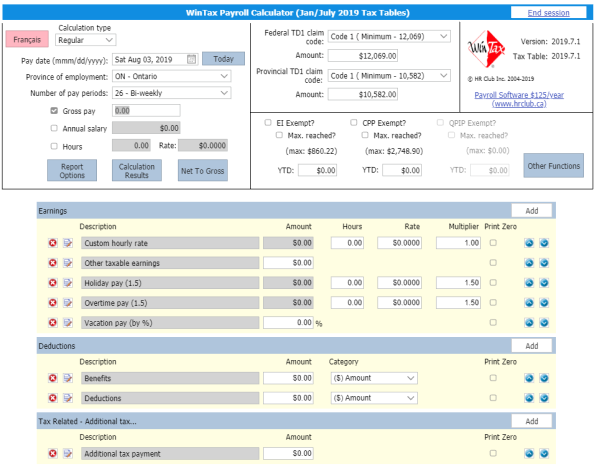

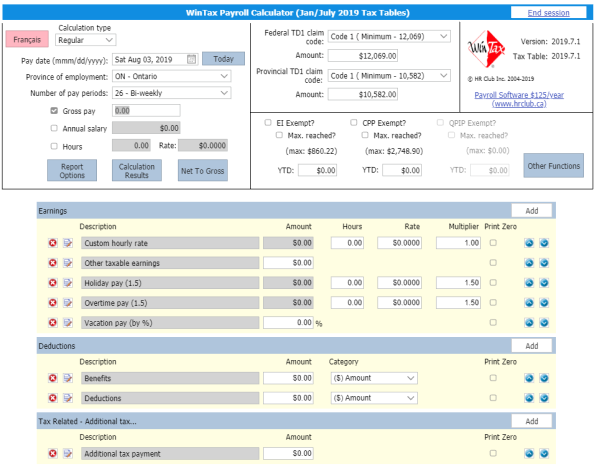

The calculator is updated with the tax rates of all Canadian provinces and territories. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right the first time around.

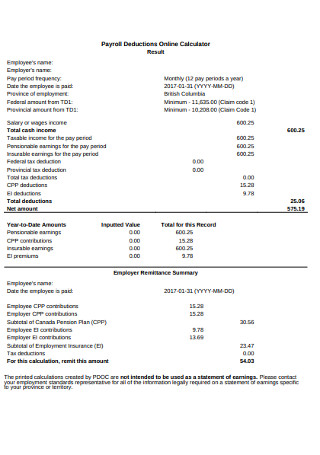

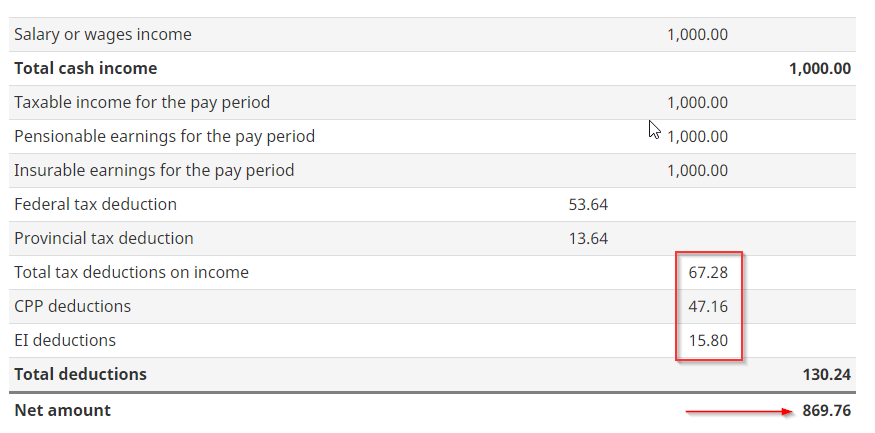

It only takes a few seconds to calculate the right amount to deduct from each employees paycheck thus saving you time and providing peace of mind. This number is the gross pay per pay period. Whether your employees are hourly or on salary.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts. Perk manages the Income Tax calculation once employees fill the tax declaration form on the app. Enter your pay rate.

Then enter the employees gross salary amount. Deducting and remitting the right amount of taxes from your employees bonuses saves everyone from tax-day hassles down the roadwhich ensures bonuses feel like perks not a prelude to end-of-year tax stress. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Alabama Payroll Tax Resources. A bonus tax calculator or payroll software that calculates and remits payroll tax automatically can help. Just in case you want to learn even more about Alabama payroll taxes here are a few.

The calculator will use those deductions when figuring your federal tax subtraction. Guide RC4110 Employee or Self-employed. Finally the payroll calculator requires you to input your employees tax information including any entitled credits along with year-to-date Canada Pension.

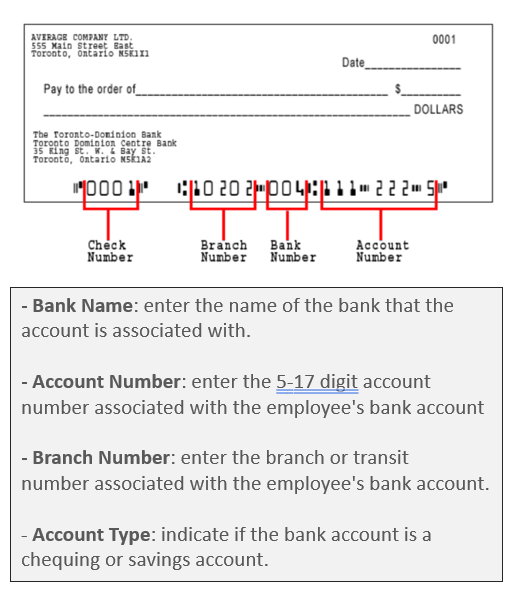

To register you will need a client ID and correspondence ID. Subtract any deductions and payroll taxes from the gross pay to get net pay. Try online payroll today.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Usage of the Payroll Calculator.

Our free online tax calculator is all you need to compare your pay under a PAYE Umbrella Company Director Umbrella Company or Personal Limited Company. Use this free online payroll calculator to estimate gross pay deductions and net pay for your employeesor yourself. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State.

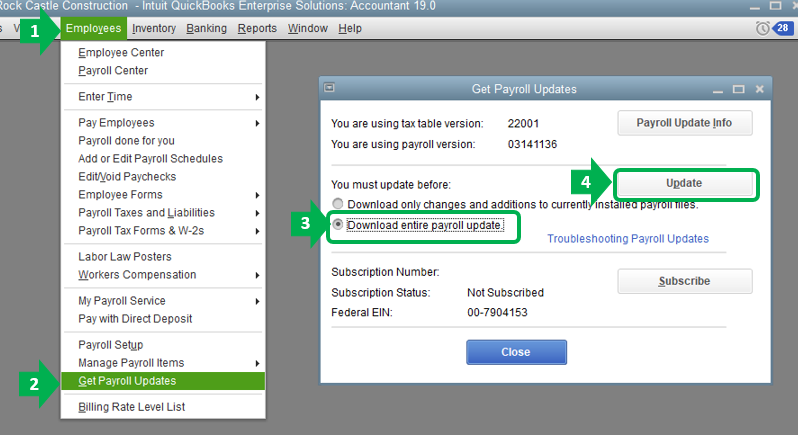

Weekly biweekly monthly etc. Dont want to calculate this by hand. You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax.

Tax Calculator Tax Brackets Capital Gains Social Security Tax Changes for 2013 - 2022. For businesses of any size. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

More details about employment tax due dates can be found here. The FICA for Federal Insurance Contributions Act tax also known as Payroll Tax or Self-Employment Tax depending on your employment status is your contribution to Social Security and Medicare as a percentage of your salary. You can pay taxes online using the EFTPS payment system.

The PaycheckCity salary calculator will do the calculating for you. You can use the calculator to compare your salaries between 2017 and 2022. Just enter income and W-4 information for each employee and the calculator will take care of the rest.

Deductions are calculated accordingly and the pay is disbursed on time. Employees State Insurance ESI Direct Deposits. Don worry as youll be assigned a Payroll Account Manager wholl will be on hand to help and ensure you recieve all entitlements and make the most of your Contract income.

Free 2022 Employee Payroll Deductions Calculator. POSC Payroll Online Service Center - This application provides employees with the following online payroll related services. The amount can be hourly daily weekly monthly or even annual earnings.

It will confirm the deductions you include on your official statement of earnings. You assume the risks. SumoPayroll is Indias fast growing free online payroll management software hosted on cloud.

Form TD1-IN Determination of Exemption of an Indians Employment Income. Employer Paid Payroll Tax Calculator. Then use the employees Form W-4 to fill in their state and federal tax information.

If your Oregon itemized deductions are less than the federal standard deduction the calculator will use the federal standard deduction when figuring the federal tax. First things first we have to pay the federal government. Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech.

These services are available for all tax professionals and their customers. Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. Calculating payroll deductions doesnt have to be a headache.

Your Easy Guide To Payroll Deductions Quickbooks Canada

Everything You Need To Know About Running Payroll In Canada

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

Mathematics For Work And Everyday Life

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Mathematics For Work And Everyday Life

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

Federal Withholding Not Calculating

Wintax Calculator Wintax Canadian Payroll Software

How To Enter Payroll Taxes Manually

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting